Scura, Wigfield, Heyer, Stevens & Cammarota Blog

- Blog

Is it Better to File Chapter 7 or Chapter 13 Bankruptcy in New Jersey?

When someone researches bankruptcy for the first time, they come across individuals discussing their experiences with two entirely different forms of bankruptcy: Chapter 7 or Chapter 13. Bankruptcy, with its numerous chapters and subchapters, might be an overwhelming to an ordinary person. It might take hours of research, for example, before one realizes that Chapter 11 is usually only an option for businesses and not private individuals trying to eradicate debt.

Without an experienced bankruptcy professional guiding your way, Chapter 7 and Chapter 13 might seem like nebulous concepts. How do you know, for example, whether you should consider liquidation? How do you know which option can better help you reorganize your credit and dispel unsecured debt? In cases like these, you need to consider what Chapter 7 Bankruptcy and Chapter 13 Bankruptcy both bring to the table, how they can help you understand and navigate your financial situation, and what you should do when and if you choose to file for bankruptcy as an individual in New Jersey.

What is Chapter 7 Bankruptcy?

Chapter 7, often called the liquidation bankruptcy chapter, allows you to eliminate, wipe out or discharge most types of debt. Unsecured debt, such as credit cards and medical bills, can be completely wiped out. All types of people and companies -- individuals, married couples, corporations and partnerships -- can file a Chapter 7 bankruptcy if eligible.

A debtor who files under Chapter 7 is entitled to retain certain assets, while the remaining assets, if any, are sold and distributed pro rata to his/her creditors to partially satisfy the debt. Often, a debtor under a Chapter 7 has a "No Asset Case".

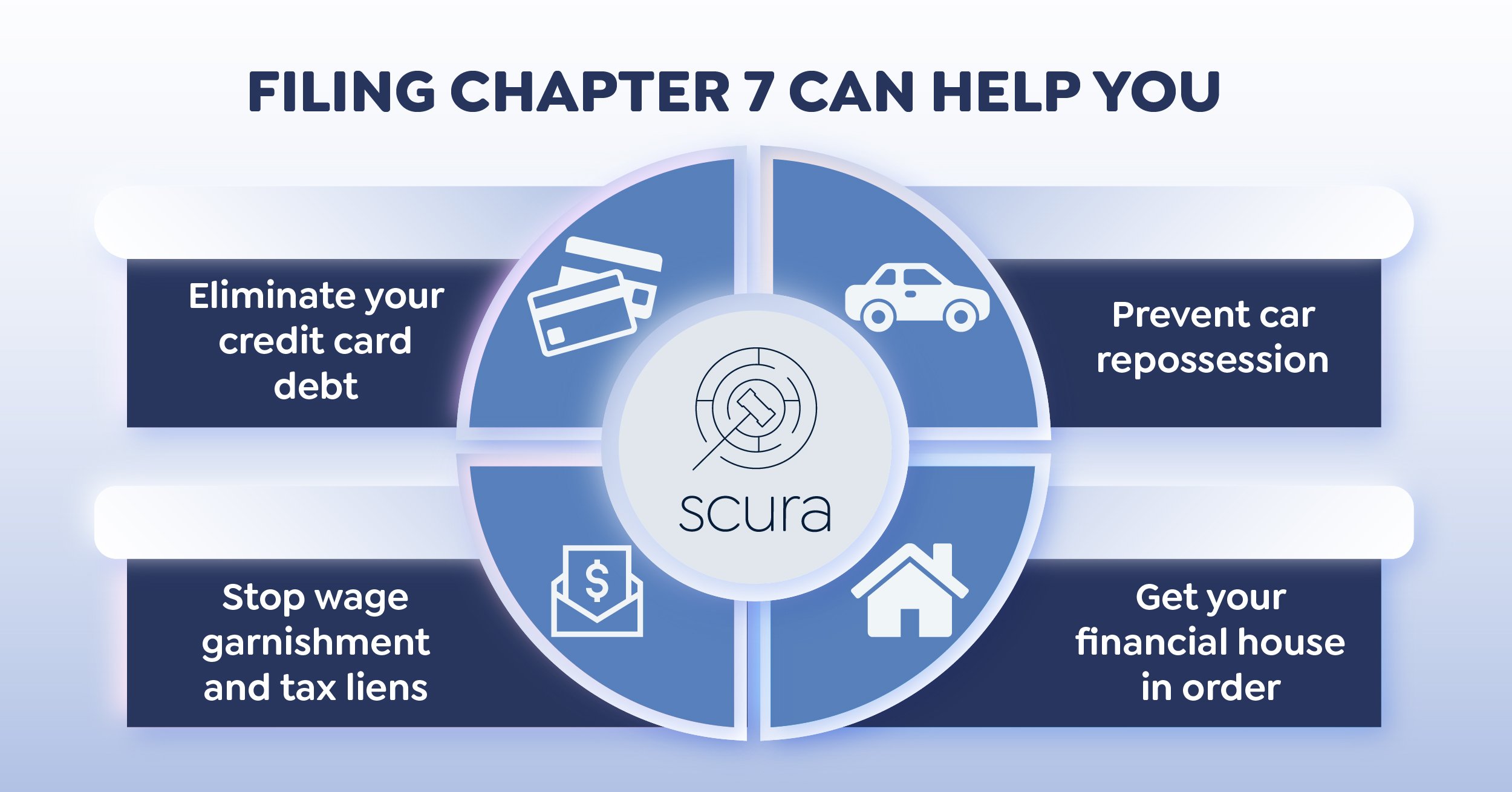

Filing Chapter 7 can help you:

- Eliminate your credit card debt

- Prevent car repossession

- Stop wage garnishment and tax liens

- Get your financial house in order

Upon filing Chapter 7 Bankruptcy, all collection activity towards you immediately ceases. All telephone calls, lawsuits, and wage garnishments will stop.

After filing a Chapter 7 Bankruptcy, the bankruptcy court appoints a trustee to examine the debtor's assets and divide them into exempt and nonexempt property. Exempt property is limited to a certain amount of equity in the debtor's residence. This means various pieces of property, including but not limited to the homestead, motor vehicle, household goods, life insurance, health aids, specified future earnings such as social security benefits and alimony, and certain other personal property, are exempt.

The nonexempt property may be sold by the Bankruptcy Trustee, who will then distribute the proceeds among the unsecured creditors.

Who Should File Chapter 7 Bankruptcy?

When looking at all this information, a question arises: who files for Chapter 7 Bankruptcy? Most Chapter 7 filers struggle monthly to pay for utilities or their house. They pay debts on credit cards, then pay off used credit on other credit cards. Their monthly living expenses are joined by monthly student loan and mortgage payments. Some Chapter 7 filers rely on payday loans or personal loans.

Liquidation seldom helps with secured debt (the secured creditor still has the right to repossess the collateral). However, the debtor will no longer be obligated to pay unsecured debts (which includes credit card debts, medical bills and utility arrearages). This does not include all unsecured debt. Certain types of unsecured debt are allowed special treatment, like some student loans, alimony, child support, criminal fines, and some taxes, and thus cannot be discharged.

Other features common among individuals filing Chapter 7 Bankruptcy? They do not have many assets. They rent vehicles or own older cars. They live with other people or live in homes marred by disrepair. Chapter 7 Bankruptcy is well-suited to them because they do not need to give up their assets. Their scant property falls under exemption.

Any debtors considering Chapter 7 bankruptcy must pass the “means test.” The “means test” compares the total household income of the debtor (not just the income of the person filing bankruptcy) to the median income of a family the same size of the debtor's household and the state of residence. If the total income is below the median income level, then you qualify for Chapter 7. If not, the test continues, calculating your disposable income and required expenditures to see if your disposable income is less than that of the average household. If debtors do not pass this test, then they must file Chapter 13 or cannot file bankruptcy at all.

What is Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy reorganizes debt. This type of bankruptcy allows the debtor to enter into an interest-free debt repayment plan which will allow debtors to pay a smaller percentage of their debts over a 3- to 5-year period, during which creditors are not allowed to pursue or maintain any collection activities or lawsuits. Success means a total discharge of creditors.

In a Chapter 13 Bankruptcy case, the debtor puts forward a plan, following the rules set forth in the bankruptcy laws, to repay all creditors using either current finances or future income. The debtor's plan outlines to the bankruptcy court how the debtor plans on paying off current expenses alongside old debt balances.

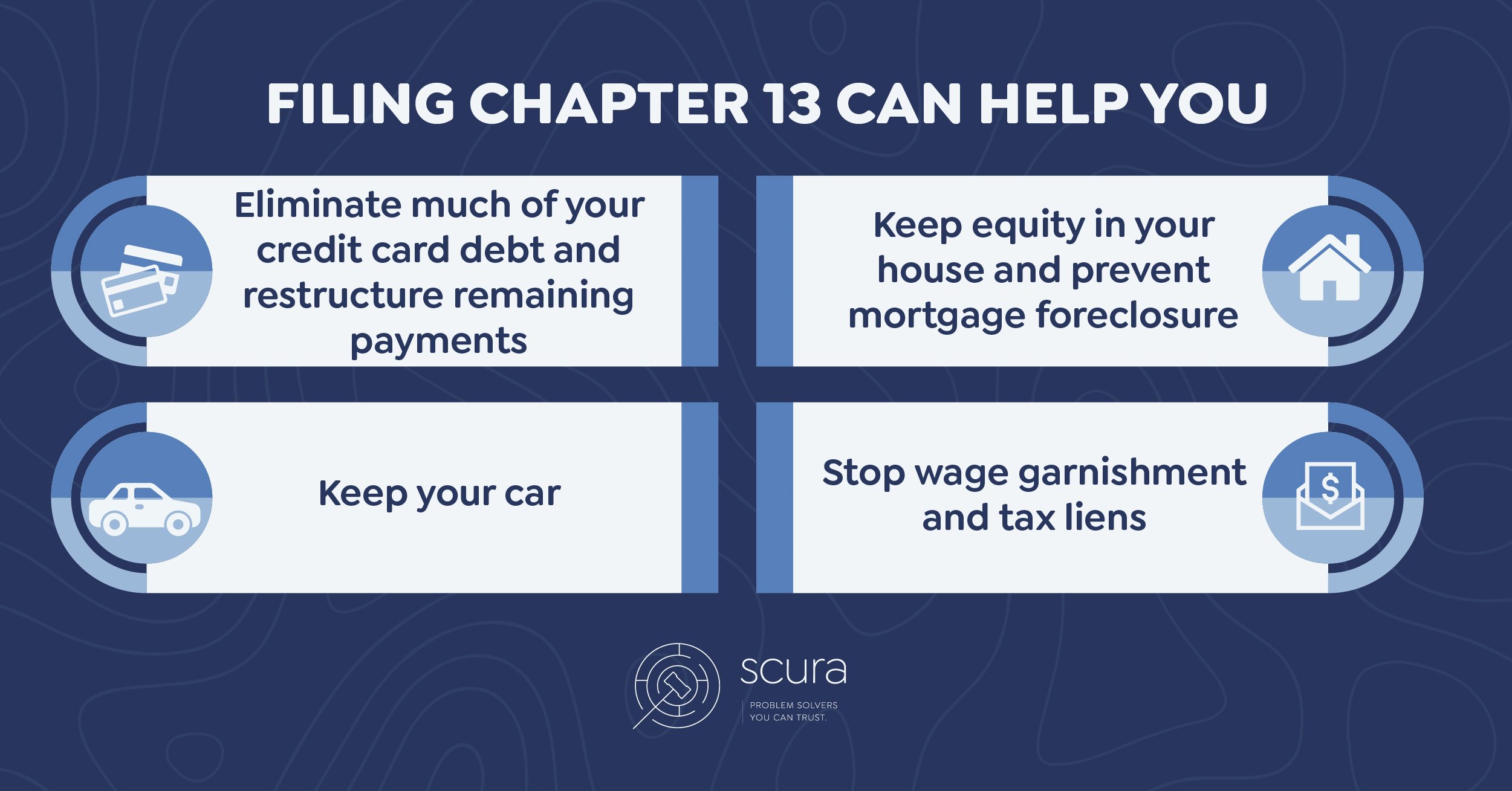

Filing Chapter 13 can help you:

- Eliminate much of your credit card debt and restructure remaining payments

- Keep equity in your house and prevent mortgage foreclosure

- Keep your car

- Stop wage garnishment and tax liens

The debtor's property is protected from seizure from creditors, so long as the debtor makes the anticipated monthly payments to the bankruptcy trustee until the plan’s completion. Arrangements can be made to have these payments made automatically through payroll deductions.

Who Should File Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy provides a mechanism for debtors to prevent foreclosures and sheriff sales, while also being able to stop repossessions and utility. Because of this, most Chapter 13 cases are used by a person looking to stave off foreclosure.

If you have outstanding debt, Chapter 13 might be beneficial to help you manage it. If your credit card debt is high and you are behind on mortgage payments, your specific plan might make it possible to pay only 5% to outstanding credit cards. For example, if you owe $100,000 in credit card debt, you may be able to pay only $5,000 over a 60-month period.

People who file Chapter 13 probably have more assets or property than those who file for Chapter 7, since liquidation is never a factor in Chapter 13 Bankruptcy. They also probably have regular income in the form of a job that makes it probable that they could pay a monthly rate to pay off their debt.

Furthermore, as mentioned earlier, not everyone can file for Chapter 7. However, Chapter 13 Bankruptcy is something anyone can file for, so long as they have a plan to pay off creditors over the course of their payment plan.

Ultimately, the choice between Chapter 7 and Chapter 13 Bankruptcy is not one that you should make lightly. You need to take into consideration all your assets and property before making a decision, as well as consulting a Bankruptcy Attorney. You need someone on your side to help you through the complicated process of filing for relief.

That is where we come in. The attorneys at Scura, Wigfield, Heyer, Stevens & Cammarota LLP can help. Please call our offices to schedule a free consultation and hear your options.

Share Article

Need Help? Contact Us Today!

Lists by Topic

- Bankruptcy (311)

- Personal Injury (89)

- Chapter 13 (51)

- Chapter 7 (50)

- Debt Management (50)

- Foreclosure (47)

- Accident (28)

- Car Accident (25)

- Chapter 11 (24)

- Business Bankruptcy (19)

- Credit (18)

- Insurance Claims (16)

- Business Law (11)

- Employment Law (11)

- Litigation (11)

- Probate and Estate Law (11)

- Attorney (10)

- Consumer Bankruptcy (10)

- Damages (10)

- Medical (10)

- Product Liability (10)

- Divorce (8)

- Workers Compensation (8)

- Slip and Fall (6)

- Commercial & Residential Real Estate (5)

- Premises Liability (5)

- Repossession (5)

- wrongful death (5)

- Contracts (4)

- Family Law (4)

- Video | Bankruptcy (4)

- Bankruptcy Cost (3)

- Corporate Litigation (3)

- Trial Law (2)

- student loans (2)

- tax (2)

- Attorney Fees (1)

- COVID-19 (1)

- Certified Civil Trial (1)

- Custody (1)

- Dog (1)

- Dog Bites (1)

- News (1)

- Relocation Assistance (1)